Click here for a printable version of this article

The benefits of knowing the rules now…

When a loved one faces the prospect of entering a nursing home, family members invariably will have many questions and concerns. Social service agencies and community programs can assist a family in locating home health care, adult day care or other social services, any of which might delay or eliminate the need for nursing home placement.

If, however, nursing home placement becomes a reality, one of the major concerns families face is the high cost of nursing home care – the average cost of nursing home care currently is over $11,000/month in New Hampshire.

Unfortunately, many people wait until nursing home care is needed before they fully explore Medicaid options for the first time. It is of great benefit to you, and your family, to understand the rules long before facing this situation. Planning ahead can make a big difference in the options available to you with respect to long-term care as well as preserving some assets.

While this article discusses financial eligibility for Medicaid coverage for single and married individuals, it primarily focuses on how a married person can qualify for Medicaid coverage without leaving his or her well spouse, or other loved ones, destitute. The following is just an overview, and, depending upon your individual circumstances and the date of this article (see cover), other options may be available. Please let us know if you have any additional questions or concerns after your review of this summary.

Consider a legal consultation. We highly recommend that you speak with an attorney with expertise in Medicaid regulations and planning before starting the Medicaid application process, as Medicaid rules are complicated and constantly changing.

What is Medicaid?

The Medicaid program is a jointly administered federal and state medical assistance program, one portion of which pays the cost of nursing home care for financially eligible individuals. The New Hampshire Department of Health and Human Services (DHHS) administers the Medicaid program. DHHS allows individuals to apply for Medicaid through local DHHS offices or through “ServiceLink” agencies located throughout the State and contracted by DHHS. You can locate the DHHS office nearest you by visiting its web site at www.dhhs.state.nh.us. You can locate the ServiceLink office nearest you through the ServiceLink web site at www.servicelink.nh.gov by clicking on “ServiceLink Locator” in the left-hand menu, or by calling 1-866-634-9412.

What are Medicaid eligibility requirements?

For a person to be financially eligible for Medicaid, he/she must be both income eligible and resource eligible at the time of application for benefits.

“Income” is money that comes into a household on a regular basis – Social Security Retirement, pension payments, annuity distributions, quarterly interest, etc.

“Resources” or “assets” are more akin to savings and include money in a checking or savings account, stocks and bonds, real estate, tangible property, etc.

Money is only income during the month in which it is received; if that money is not spent, it is considered a resource the following month.

What is “resource” eligibility?

As of January 2024, an applicant may only have $7,500 in “countable” resources to be eligible for either Medicaid nursing facility benefits or Medicaid home care benefits; if the applicant is married, there are special rules pertaining to protections for the community spouse (discussed below). This is known as the resource limit. Examples of countable resources are stocks, bonds, bank accounts, IRAs and cash surrender value of life insurance policies.

The full value of any money held in a joint account generally will be considered a countable resource to the Medicaid applicant, as all funds will be presumed accessible to the applicant. An individual who holds money jointly with an applicant, such as the applicant’s child, can protect his or her interest in the account, however, by demonstrating regular contributions to the account or, in the rare case, by proving that the account was established as a joint account prior to November 1, 1995. If this proof is provided, only a proportional share of the account will be considered a countable resource to the applicant.

Some exceptions…

Not all resources are countable. For instance, a person’s home and personal property are not counted towards the resource limit. Examples of other non-countable resources include at least one vehicle and irrevocable funeral trusts.

Property that has been placed in an irrevocable trust that conforms to Medicaid standards will not be counted towards the resource limit since the assets belong to the trust, not the applicant or the applicant’s spouse. However, please be aware that many irrevocable trusts do not conform to the Medicaid standards (see In re Estate of Thea Braiterman (NH Supreme Court Decision, 2016) and should be reviewed by an attorney prior to filing for Medicaid benefits. Please also refer to the later section of this article relating to transfers of assets, since transferring property into an irrevocable trust may disqualify someone from Medicaid.

If the Medicaid applicant is single…

With respect to either Medicaid nursing facility benefits or Medicaid home care benefits, if an applicant is single, the resource eligibility rule is simple: the applicant will be eligible for Medicaid once he or she has $7,500 or less in countable resources remaining. For instance, if a single man had $20,000 in countable resources at the time of institutionalization, he would not be eligible for Medicaid until he had spent $12,500.

If the Medicaid applicant is married…

If an applicant is married, however, the resource eligibility rules for Medicaid nursing facility benefits are considerably more complicated. All countable resources owned by the applicant, the applicant’s spouse, or both, are taken into consideration. Therefore, the first step in the Medicaid application process for a married applicant is for the couple to request a “resource assessment” from DHHS. A resource assessment is not a Medicaid application. Rather, it is the method by which the applicant and spouse can learn the State’s official determination of the value of the couple’s countable resources.

On the other hand, as of January 2024, the resource eligibility rules for Medicaid home care benefits for a married applicant became far less complicated. Under the new rules, resources titled in the name the applicant’s spouse no longer will be counted. Accordingly, since only countable resources in the name of the applicant will be taken into consideration, a resource assessment will not be required.

The importance of requesting a “resource assessment” early…

The resource assessment is intended to provide an accurate picture of the couple’s finances at the specific point in time when the applicant was first institutionalized. It will provide the couple with the description and value of those resources DHHS contends are countable. The resource assessment will also specify the dollar value of the resources the community spouse is allowed to retain, as well as how much money must be “spent down” by the couple before the institutionalized spouse will be eligible for Medicaid. The resource assessment should be reviewed carefully in case an inadvertent error was made by DHHS.

We recommend that a resource assessment be requested as early as possible. It is a crucial planning device, because, without such an assessment, the couple may expend more assets than necessary, or protect less of their resources than the law allows.

Spousal resource allowance …

Medicaid rules expressly protect a portion of a couple’s resources for the community spouse. This portion is known as the “spousal resource allowance” and is designed to prevent the community spouse from becoming impoverished.

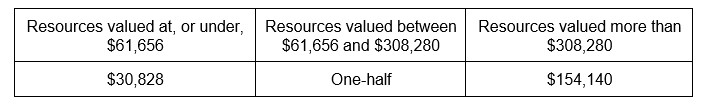

The general rule for nursing facility Medicaid benefits is that the community spouse is permitted to retain one-half of the couple’s countable resources; however, there is both a minimum and maximum resource allowance, as illustrated by the following chart:

Spousal Resource Allowance as of January 1, 2024

|

Therefore, the community spouse is permitted to retain at least $30,828 worth of the couple’s countable resources, or one-half of the assets up to a maximum of $154,140. The spousal resource allowance is scheduled to increase every year on January 1st in accordance with the consumer price index.

The institutionalized spouse will be able to retain $7,500 (which is the resource eligibility limit for Medicaid applicants). Under these rules, a couple with $400,000 total countable resources at the time of resource assessment would be entitled to protect $161,640 and would be advised to spend $238,360 before the institutionalized spouse would be eligible for Medicaid:

$154,140 (Spousal resource allowance for at-home spouse)

+ $7,500 (Institutionalized spouse’s resource limit)

$161,640 (Total protected)

$400,000 (Countable resources)

– $161,640 (Total protected)

$238,360 (“Spend down”)

The “spend down”…

After the resource assessment is complete and the couple has been informed by DHHS as to how much they must spend before the institutionalized spouse can apply for Medicaid, the couple understandably may be concerned about the impact that the required “spend down” will have on the community spouse.

Medicaid “spend down” planning can take place after the resource assessment and should take place before a formal Medicaid application is made. A carefully planned “spend down” can serve to lessen this impact.

Planning your “spend down”…

First of all, the spend-down amount does not have to be spent solely on nursing home care. The money can be spent on any item or service that provides value to either spouse. For instance, the money can be spent making long-overdue repairs to your home, purchasing a car to replace an existing vehicle, traveling, etc. – as long as the couple is receiving value for their money.

There are other planning options, such as purchasing an annuity to benefit the community spouse in order to provide a reliable stream of income. It is important to understand and carefully consider the disqualification rules pertaining to transferring assets prior to making gifts to individuals other than a spouse. See the discussion of “spend down” traps later in this article.

What is Income eligibility?

A Medicaid applicant’s income eligibility is determined by comparing the applicant’s income to the Medicaid reimbursement rate for the specific nursing facility in which he or she is residing. Only the applicant’s income is counted when determining income eligibility. If the applicant is married, the spouse’s income is ignored. Medicaid reimbursement rates currently exceed $5,500/month Medicaid nursing facility reimbursement rates for private and county nursing homes (not including skilled nursing facility care or atypical beds) generally ranging from $5,500 – $7,500 per month.

If the Medicaid applicant’s gross income is less than the Medicaid reimbursement rate at the nursing facility in which he or she is residing, the applicant will be considered eligible for Medicaid.

If an applicant’s gross income is higher than the Medicaid reimbursement rate, the applicant will not be considered eligible for Medicaid unless the applicant has certain expenses that are considered permissible deductions. There are a limited number of deductions allowed when determining income eligibility, including court-ordered spousal support payments. We highly recommend speaking with a knowledgeable attorney regarding the available options in such a situation.

“Spousal income allowance”…

If the Medicaid application is ultimately approved, the community spouse may be entitled to a portion of the institutionalized spouse’s income, known as the “spousal income allowance.” The community spouse might be entitled to receive a larger portion of the institutionalized spouse’s income to help pay household expenses. Note that the community spouse cannot be forced to use any of his or her own income to help pay for nursing home care once the institutionalized spouse is on Medicaid.

The starting point in figuring out whether a community spouse is entitled to an income allowance is the “minimum monthly maintenance needs allowance,” which currently is $2,555 (effective July 1, 2024). If the community spouse’s individual income is less than $2,555, they are entitled to receive a portion of the institutionalized spouse’s income equal to the amount needed to bring the community spouse’s income up to that figure.

The next step in determining the income allowance for a community spouse is analyzing the community spouse’s “shelter costs.” Shelter costs are those costs associated with carrying the home, such as home insurance, mortgage payments, rent, condominium fees, property taxes, and utility costs. The community spouse must total his or her shelter costs and compare those costs to the required “excess shelter deduction,” currently $766.50 (effective July 1, 2024).

If the community spouse’s monthly shelter costs are greater than $766.50, he or she is entitled to a larger portion of the institutionalized spouse’s income. The income allowance will be increased dollar for dollar by these “excess shelter costs,” up to a maximum of $3,854 (as of January 1, 2024). This figure is known as the “maximum monthly maintenance needs allowance”.

The minimum and the maximum monthly maintenance needs allowances increase every year on July 1st and January 1st respectively with the consumer price index.

Note that if the community spouse is awarded a support order from a court to cover living expenses, the state will honor it, even if it brings the community spouse’s income above the maximum monthly maintenance allowance of $3,854.

Mr. and Mrs. Reynolds: An example

Mr. Reynolds enters a nursing home. His total monthly gross income of $2,500 includes a pension of $1,500, and social security retirement payments of $1,000. Mrs. Reynolds has a social security monthly income of $600, and a small pension of $255, for a total gross monthly income of $855.

Mr. and Mrs. Reynolds own a home. Between real estate taxes, a mortgage, utility costs and homeowners’ insurance, Mrs. Reynolds has monthly shelter costs totaling $1,166.50.

Mrs. Reynolds’ income allowance would be calculated as follows:

$2,555 (Minimum monthly maintenance standard)

– 855 (Mrs. Reynolds’ individual income)$

$1,700 (Minimum spousal income allowance)

$1,165.50 (Mrs. Reynolds’ shelter costs)

– 766.50 (Excess shelter deduction)

$ 400 (Excess shelter costs)

$ 1,700 (Minimum spousal income allowance)

+ $ 400 (Excess shelter costs)

$ 2,100 (Spousal income allowance from husband’s income)

$2,100 (Spousal income allowance from husband’s income)

+ 765 (Mrs. Reynolds’ own income)

$2,865 (Mrs. Reynolds’ total monthly maintenance allowance)

Your right to a hearing …

If the monthly maintenance allowance is not adequate to meet the community spouse’s expenses, the community spouse may be able to obtain an increase through a fair hearing. You may also appeal any Medicaid eligibility decision if you believe an error has been made.

Beware “spend down” traps: Know the rules concerning transfers of property and related disqualification periods.

Some people facing the need for a nursing level of care believe that they must impoverish themselves to become eligible for Medicaid. While this may not be far from the truth, before you give away any assets in order to meet the Medicaid “spend down,” it is essential that you understand the rules concerning the transfer of property, and how these rules could impact Medicaid eligibility.

Both federal and state governments have enacted laws that could disqualify you from Medicaid eligibility, with some exceptions, if property/assets are deliberately given away in order to reduce resources. DHHS will presume that any transfers you have made within a certain time prior to your Medicaid application are disqualifying unless you received fair market value in exchange.

In order to determine the disqualification period applicable to a gift (defined as a “transfer of property for less than market value”), five factors must be considered:

- The applicable “look-back” period;

- The date of the gift;

- The value of the gift;

- The applicable “disqualification” period; and

- The average monthly cost of nursing home care ($11,809 in NH as of January 1, 2024).

The look-back period. At the time of applying for Medicaid, the applicant must reveal any gifts made within the prior 60 months (5 years) – this is commonly known as the Medicaid “look-back period.” Any gifts made more than 60 months prior to the date of application do not have to be revealed.

The value of the gift. The value of the gift, in conjunction with the average cost of nursing home care, will determine the time period (measured in months) of “disqualification” from receiving Medicaid benefits. For example, a $140,000 gift would disqualify an applicant for 12 months ($140,000 / $11,809 = 11.9).

When does the “disqualification period” begin to run?

The disqualification will not begin to run until the individual applies for Medicaid and was “otherwise eligible” to receive Medicaid benefits.

For example, if a $140,000 gift was made 24 months before a Medicaid application is filed, the applicant would be denied Medicaid benefits and would be advised that he or she would not be eligible for Medicaid benefits until a 12-month disqualification period had passed.

Important note: Not all transfers of assets are subject to these rules. For instance, a transfer of an asset from one spouse to another is never subject to these rules. Similarly, a parent’s transfer of assets to a child who has been declared disabled under the Social Security standards is not subject to these rules. Furthermore, there are special rules relating to the transfer of a home, detailed below.

Treatment of your home…

If you are single. A single person can be required to sell his or her home within six months of receiving Medicaid if there are no other owners of the home, if the home has not been rented and is not producing income, or if certain qualifying individuals are not living in the home. These qualifying individuals include a disabled adult child, a minor/ dependent child and a “caregiver child” (see below).

If you are married. For married couples, the home is always protected for the community spouse. The community spouse will not be required to sell the home, and a lien will not be placed on the home. As noted earlier, the home is not a countable resource for Medicaid eligibility purposes. However, in New Hampshire, a Medicaid applicant’s equity in the primary residence over $713,000 (as of January 2024) will be considered a countable resource unless a spouse, minor or disabled child is lawfully residing in the residence. The community spouse’s equity in the primary residence is not subject to a maximum. Please note: If a house is titled in the name of a revocable trust, the New Hampshire DHHS will require the house be removed from the trust and titled in the name of an individual owner(s), otherwise, the full value of the house will be a countable resource.

Whether you are married or single, if your home is owned jointly with any other second or third party, there can be no forced sale of the home. However, the state may pursue recovery against joint owners up to the value of a Medicaid recipient’s interest, as detailed later in this article.

Other important factors regarding home ownership and Medicaid eligibility …

In addition to the community spouse and other co-owners of real estate, other individuals receive protection under the Medicaid rules.

For instance, if a disabled adult child or a minor/dependent child lives in the home, the home cannot be sold and a lien cannot be placed on it. In fact, the home could be transferred (that is, “gifted” to them) to a disabled adult child or minor/dependent child without jeopardizing Medicaid eligibility.

Similarly, if an adult child lives in the home and has been providing care to the Medicaid applicant for at least two years prior to a nursing home admission, enabling the Medicaid applicant to remain at home rather than in a nursing home, this child is considered a “caregiver child,” and the same protections apply.

Protections also apply to siblings of an applicant who have an equity interest in the home and had been residing in the home for at least one year prior to the applicant’s nursing home admission.

Your estate: The limitations of government recovery/reimbursement …

When a Medicaid recipient dies, the state government has an obligation to recover the Medicaid funds (both federal and state) that have been paid towards nursing home care. However, there are very specific limits on the state’s rights to seek recovery of these monies and to require reimbursement, as follows:

- Recovery/reimbursement can never take place during the lifetime of the Medicaid recipient’s spouse.

- Recovery/reimbursement is only permitted against the estate of the Medicaid recipient, and not against the estate of the Medicaid recipient’s spouse.

- There are restrictions on the state’s right to place a lien against a home, particularly if a spouse, or other protected individual (such as a dependent or disabled child, see above) is living there.

In 2005, the State of New Hampshire expanded Medicaid recovery to encompass “life estates” and joint tenancies in real estate, as well as any asset held by the Medicaid recipient in joint name regardless of when the joint ownership or life estate was established. Under this law, the State has the authority to seek recovery from the other joint owners for the amount of Medicaid paid on behalf of the deceased Medicaid recipient, up to the value of the Medicaid recipient’s ownership interest in the asset immediately prior to death. Recovery shall not apply to property interests established prior to July 1, 2005, or to non-recipients who paid fair market value for an ownership interest at the time the property was acquired. See RSA Ch. 167:14-a, VI.

In Conclusion …

If you or a family member is facing a nursing home admission and the potential need for Medicaid benefits, the experience can be stressful and full of unknowns. Consulting with an attorney who is experienced in Medicaid planning and elder law about your particular circumstances may bring peace of mind, the opportunity to preserve your assets and the possibility of better care options. The sooner you schedule a consultation, the more options you will have available as you plan for your future.